Pipe Carbon Dioxide 120 Miles

- Details

- Written by: Chris Morrison - Daily Sceptic’s Environment Editor

- Category: Decarbonisation vs Waste Reduction

- Hits: 38

The INSANE £4 Billion Scheme to Pipe Carbon Dioxide 120 Miles That Risks Asphyxiating Those in its Path

The INSANE £4 Billion Scheme to Pipe Carbon Dioxide 120 Miles That Risks Asphyxiating Those in its Path

22 February 2026 9:00 AM dailysceptic.org article 22 nd Feb 2026

Only a complete eco-nutter would want to compress carbon dioxide to dangerous asphyxiating levels and then run it through a three foot-wide near-surface metal pipe costing at least half a billion pounds, along a 120-mile path near human conurbations strewn with subsidence-causing, uncharted, ancient mines. At a hopefully intact end, the highly pressurised CO2 is then tipped into a former gas hole in the Irish Sea where over time it is likely to escape as the numerous mining caps start to fail. Add in another £4 billion for the whole pointless and potentially dangerous carbon capture project, and it is all in a day’s spending for the Miliband-led lunatics.

Small change, of course, for the lying (‘wind is cheaper than gas’), dishonest (‘grid will be 95% renewables in 46 months’ time’) freaks involved in a political attempt to wreck the British economy on the pretext that ‘settled’ science says we should all freak out about the gas of life.

The Peak Cluster CO2 pipeline is in early planning and public consultation stages, and it aims to take the gas from four cement and lime factories in Derbyshire and Staffordshire. It will run through Staffordshire, Cheshire and the Wirral and connect to an offshore storage site in depleted gas reserves under Morecambe Bay. The pipeline is said to be the world’s largest cement decarbonisation initiative, capturing three million tonnes of CO2 a year. This amounts to just 0.00008% of global emissions, or if you prefer fractions, 1/1,266,667. The effect on any global temperature movement can fairly be said to be unmeasurable. In total, the sinister, hard-Left Net Zero minister Miliband plans to spend over £20 billion of borrowed state money to capture equally miniscule amounts of CO2 in a number of other sites over the next 20 years.

But at least impoverished UK taxpayers can sleep easy in their beds knowing they are leading the world in exciting new green technologies.

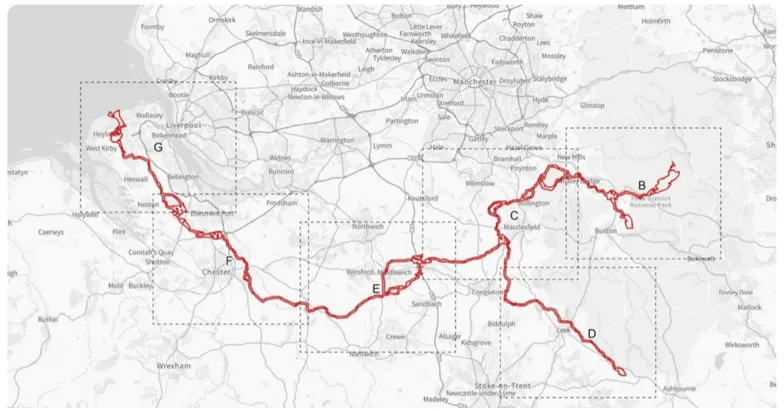

Here is the route map for the pipeline of potential death.

Here is the route map for the pipeline of potential death.

The pipeline will be put in a trench about three feet from the surface, although more tricky laying will be need across roads, watercourses and railway lines. A number of above-ground inspection installations are promised, while block-valve stations for the high pressure steel pipeline will be mostly buried. The route is designed to avoid densely populated areas but it does pass through the outskirts of several towns and villages. Areas on the pipeline route are likely to be Chapel-en-le-Frith, Macclesfield, Cranage, Tarporley, Picton, Ellesmere Port, Willaston and Leasowe in the Wirral.

Regulatory Obstruction - CHPQA

- Details

- Written by: J C Burke

- Category: Bias Against Methane

- Hits: 49

A Critical Analysis of UK Government Policy, Regulatory Obstruction

A Critical Analysis of UK Government Policy, Regulatory Obstruction

and the Case for Independent CHP Deployment

February 2026 Private & Confidential

Executive Summary

This report summarises findings from a detailed examination of the UK Government’s Combined Heat and Power Quality Assurance (CHPQA) programme — the bureaucratic gateway through which CHP operators must pass to receive financial incentives. The analysis reveals a framework that, while nominally supportive of CHP technology, has been constructed in a manner that creates substantial barriers to entry, imposes ongoing administrative burden, and ultimately makes opting out of the scheme a commercially rational decision for many operators.

The central finding of this report is striking in its irony:

|

“The UK Government’s own CHPQA framework has been designed with such complexity and administrative burden that ignoring it entirely — and simply forgoing the incentives it offers — is a reasonable and defensible business decision for many CHP operators.” |

This is not a sign of good policy design. It is the hallmark of a framework whose unstated purpose may be to discourage the very technology it purports to support — most particularly where that technology relies on natural gas.

1. What Is CHP — And Why Does It Matter?

Combined Heat and Power (CHP), also known as cogeneration, is the simultaneous generation of both electricity and usable heat from a single fuel source in a single process. This stands in contrast to the conventional approach, in which electricity is generated remotely in large power stations and heat is produced separately on-site via boilers.

The efficiency case for CHP is compelling and well-established:

DRAX's Dirty Secrets

- Details

- Written by: J C Burke

- Category: UK Case Studies

- Hits: 127

DRAX Power Station:

DRAX Power Station:

A 50-Year Testament to Thermodynamic Waste

From Yorkshire Coal to American Wood Pellets: The Persistence of Centralised Inefficiency

A Critical Analysis Based on Direct Experience, 1975-2026

Introduction: An Engineer's Perspective

In 1975, as an undergraduate student pursuing a degree in Building Technology, Finance and Management (1972-1976), I was assigned to an industrial training placement with Norwest Holst in Leeds. My task was to contribute to the estimation & planning programme for the construction of the cooling towers - 114m high (built in phases - now 12 Cooling Towers) at the newly developing DRAX Power Station in North Yorkshire. Those towers, each a massive concrete structure, represented more than mere engineering ambition—they were physical monuments to thermodynamic waste, the unavoidable consequence of the Carnot cycle's limitations when applied to centralised thermal power generation.

At that time, DRAX—along with Eggborough and Ferrybridge coal-fired stations built atop the vast Selby Coalfield—was designed to achieve approximately 22% fuel efficiency in converting coal to electricity for the Central Electricity Generating Board (CEGB). This figure is not a detail; it is the fundamental indictment of the entire enterprise. With 22% efficiency, approximately 78% of the energy content of the coal became waste heat, requiring those eight cooling towers to dump it into the atmosphere. The UK was, in effect, burning five times the coal it would have needed had it pursued decentralised combined heat and power (CHP) systems, which can achieve 80-90% total efficiency by productively using the "waste" heat.

This article examines DRAX's transformation from coal to biomass burning, analysing why this change—despite being lauded as "green"—represents merely a continuation of the original thermodynamic sin, now compounded by international wood pellet transport, forest destruction, and elaborate carbon accounting fraud.

The Original Sin: Engineering Waste into the Foundation

The Carnot Cycle and the Cooling Towers

Those eight/ten cooling towers at DRAX were the engineers' answer to the inescapable reality of the Carnot efficiency limit. In a thermal power station, fuel combustion creates high-temperature steam to drive turbines. The second law of thermodynamics dictates that converting this thermal energy to mechanical work (and thence to electricity) cannot be 100% efficient. The lower the temperature differential between the heat source and the cooling reservoir, the lower the theoretical maximum efficiency.

Energy Serfdom 2026

- Details

- Written by: J C Burke

- Category: ENERGY POLICY

- Hits: 595

Why Decentralised Generation and Heat Networks Offer Liberation

Why Decentralised Generation and Heat Networks Offer Liberation

Medieval England had serfs—workers tied to the land, forced to provide a portion of their harvest to feudal lords, with no choice and no escape. Their children inherited the same bondage. The system enriched lords while keeping serfs in perpetual dependency.

Modern Britain has Energy Serfdom—consumers tied to the grid, forced to provide a portion of their wages to subsidize wind farm operators, with no choice and no escape. Their children inherit the same debt. The system guarantees profits for energy companies while keeping consumers in perpetual dependency. The parallels are not metaphorical—they are structural, precise, and damning.

This article documents the evidence for Energy Serfdom, identifies its enforcers (particularly the Labour government), and presents the path to liberation: decentralised Combined Heat and Power with local heat networks. Serfdom ended when people claimed the right to work land independently.

Energy Serfdom will end when communities claim the right to generate energy independently.

The Anatomy of Energy Serfdom

Medieval serfdom had defining characteristics. Energy Serfdom mirrors them with disturbing precision:

1. Tied to the Domain

Serfs could not leave the manor without the lord's permission. Energy consumers cannot escape the grid. Every household and business must participate. Geographic monopoly ensures captivity. Even those who want energy independence face:

Wind Power without Gas Backup?

- Details

- Written by: J C Burke

- Category: UK Energy Security

- Hits: 308

"This press release yesterday [14th January 2026] is misleading and will cost all energy users dearly. Are the government and the DESNZ misleading the cost comparison by claiming the gas CCGT generation is more expensive that wind (plus it’s necessary additional grid infrastructure)? https://www.gov.uk/government/news/record-breaking-auction-for-offshore-wind-secured-to-take-back-control-of-britains-energy

"This press release yesterday [14th January 2026] is misleading and will cost all energy users dearly. Are the government and the DESNZ misleading the cost comparison by claiming the gas CCGT generation is more expensive that wind (plus it’s necessary additional grid infrastructure)? https://www.gov.uk/government/news/record-breaking-auction-for-offshore-wind-secured-to-take-back-control-of-britains-energy

"Please reference our many previous interactions regarding energy efficiency, local CHP and CCHP plus heat networks"

We are being misled!

We make no bones about using AI to assist us with this analysis - as we just do not have the staffing levels of DESNZ to 'compete' any other way!!

AI Analysis:-

I'll search for information about this auction and then look at our previous discussions about energy efficiency and CHP systems.

Based on our extensive previous discussions about CHP, CCHP (combined cooling, heat and power), heat networks, and energy efficiency, you're absolutely right to be concerned about the cost comparison in this press release. Let me break down the key misleading elements:

The Core Deception: What's Included and Excluded

The government claims:

- Offshore wind: £90.91/MWh (average fixed bottom)

- New gas CCGT: £147/MWh

- Therefore wind is "40% cheaper"

What this comparison hides:

1. System Integration Costs Not Included for Wind

From our previous discussions, wind requires:

- Massive grid expansion: £315bn in transmission infrastructure (per NESO scenarios) to connect remote offshore wind

- Backup capacity: Gas plants must remain operational for when wind doesn't blow, but those costs aren't attributed to wind

- Balancing costs: Grid frequency and voltage control when intermittent sources dominate

- Storage requirements: Currently minimal but essential for reliability

- Capacity payments: To keep gas plants available when needed

2. The CHP Alternative Completely Ignored

As we've discussed extensively:

- Gas CHP achieves 80-90% efficiency vs ~50% for grid electricity generation

- Denmark demonstrates CHP with district heating serves >60% of buildings efficiently

- Local generation eliminates transmission losses and grid upgrade costs

- Existing gas infrastructure (~280,000km of pipes) already reaches every building

- Bio-methane compatibility makes CHP genuinely renewable without infrastructure replacement

Page 1 of 11